- Topic

40k Popularity

42k Popularity

148k Popularity

6k Popularity

19k Popularity

- Pin

- 🎉 Hey Gate Square friends! Non-stop perks and endless excitement—our hottest posting reward events are ongoing now! The more you post, the more you win. Don’t miss your exclusive goodies! 🚀

🆘 #Gate 2025 Semi-Year Community Gala# | Square Content Creator TOP 10

Only 1 day left! Your favorite creator is one vote away from TOP 10. Interact on Square to earn Votes—boost them and enter the prize draw. Prizes: iPhone 16 Pro Max, Golden Bull sculpture, Futures Vouchers!

Details 👉 https://www.gate.com/activities/community-vote

1️⃣ #Show My Alpha Points# | Share your Alpha points & gains

Post your - 💙 Gate Square #Gate Blue Challenge# 💙

Show your limitless creativity with Gate Blue!

📅 Event Period

August 11 – 20, 2025

🎯 How to Participate

1. Post your original creation (image / video / hand-drawn art / digital work, etc.) on Gate Square, incorporating Gate’s brand blue or the Gate logo.

2. Include the hashtag #Gate Blue Challenge# in your post title or content.

3. Add a short blessing or message for Gate in your content (e.g., “Wishing Gate Exchange continued success — may the blue shine forever!”).

4. Submissions must be original and comply with community guidelines. Plagiarism or re

Strategist warns Bitcoin at risk of being abandoned for this ‘next big trade’

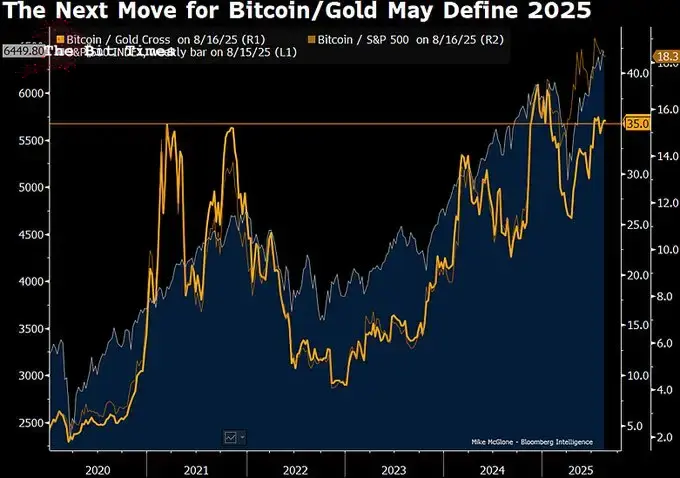

Bloomberg Intelligence senior commodity strategist Mike McGlone has warned that Bitcoin (BTC) faces a critical test against gold that could shape investor flows for the remainder of 2025.

Bloomberg IntelligenceHe pointed to a key ratio comparing Bitcoin’s value to gold, showing the world’s largest cryptocurrency hovering around 35 ounces of gold per Bitcoin, a level that previously marked the 2021 peak.

In an X post on August 16, McGlone cautioned that if Bitcoin fails to hold above this threshold, it may trigger a shift in capital toward U.S. Treasuries as the “next big trade.”

“If the first-born crypto in 2009 — now with about 19-million minions — backs down from roughly 35 ounces of the rock on Aug. 15, it may signal T-bonds as the NBT,” he said

He suggested that Bitcoin’s inability to defend the level could cement Treasuries as the preferred haven, with yields potentially sliding toward 1.75%, mirroring a trajectory seen in China.

McGlone’s Analysis indicated that BTC’s performance relative to both gold and the S&P 500 has surged in recent years but now sits at a crossroads

Analysis Bitcoin/Gold ratio chart. Source: Bloomberg Intelligence**Bitcoin/Gold ratio chart. Source: Bloomberg IntelligenceTo this end, he noted that the Bitcoin-to-S&P 500 ratio currently hovers around 18.3, highlighting the cryptocurrency’s resilience against equities. However, the gold threshold appears to be the more decisive marker for long-term positioning.

Bitcoin/Gold ratio chart. Source: Bloomberg Intelligence**Bitcoin/Gold ratio chart. Source: Bloomberg IntelligenceTo this end, he noted that the Bitcoin-to-S&P 500 ratio currently hovers around 18.3, highlighting the cryptocurrency’s resilience against equities. However, the gold threshold appears to be the more decisive marker for long-term positioning.

Stalled Bitcoin and gold ratio

On August 15, McGlone stated that the stalled Bitcoin-to-gold ratio sits at a key juncture, poised to either catch up with record U.S. stocks or signal a broader risk-asset reversion heading into late 2025.

Stalled Bitcoin vs. Gold a Top Leading Indicator –

Poised to catch up to the record-setting stock market or signaling reversion in elevated risk assets are primary 2025 year-end options for the Bitcoin/gold ratio.

Full report on the Bloomberg here: {BI… pic.twitter.com/FvZfHYLhnl

Notably, Bitcoin’s stalled gains against gold highlight uncertainty over digital assets’ resilience amid inflation, central bank policy, and geopolitical risks. McGlone suggested a breakout would signal renewed confidence in risk assets, while stagnation could foreshadow pullbacks in equities and crypto.

Meanwhile, both Bitcoin and gold have enjoyed an impressive run in 2025. Gold, at one point, targeted an all-time high of $4,000, while Bitcoin recently surged past $124,000, marking a new record. At press time, Bitcoin was trading at $118,266, maintaining its position well above the $100,000 level.

Featured image via Shutterstock

Featured image via ShutterstockFeatured image via Shutterstock